How to Guard Yourself Against Identity Theft

A Growing Crime

Identity theft is one of the fastest growing crimes in the world and nobody is safe from this unpleasant criminal activity. In the US the Internal Revenue Service lists identity theft as one of the leading scams that has to be dealt with each year. Everyone should take precautions to prevent becoming a victim of this ruthless fraud.

The Threat of Identity Theft

Identity theft is one of the fastest growing crimes in the world and nobody is safe from this unpleasant criminal activity. Your identity can be used to run up debts in your name or to take money directly from your bank account and can have very unpleasant consequences. Prevention is the best cure and the more knowledge everyone has about identity thieves and their methods the more effective the precautions that can be taken. In the US, the Internal Revenue Service lists identity theft as one of the leading scams that has to be dealt with each year, posing serious problems to government agencies in doing their work and causing severe stress and loss to victims.

Some identity thieves aim to steal documents that can be used to obtain services in another person’s name. This can be done by stealing documents such as bank statements or utility bills from litter bins and posing as the person whose name appears on the document. Some identity thieves simply look over people’s shoulder in the bank or at the cash machine, obtaining useful information about card numbers and PIN numbers. People using their laptops in public places can be victims of these shoulder surfers who look at the information on the computer screen and use it for their own criminal purposes.

The use of false automatic telling machines (ATMs) has become a real threat. A fake machine may be set up or a device attached to an existing machine. In some cases the user’s debit card may be stolen and the password used with the card can be picked up by the software attached to the machine. To be safe from this form of theft it is advisable to use a cash machine inside the bank if possible and to be vigilant when using a machine out in the street.

Once a criminal has your personal details they can be used for purposes of theft or they can even be sold to other criminals for further use. Suddenly your personal details can become a commodity to be bought and sold in criminal circles. The result will be repeated instances of theft from the bank account or debts accumulated in the name of the victim.

Online Identity Theft

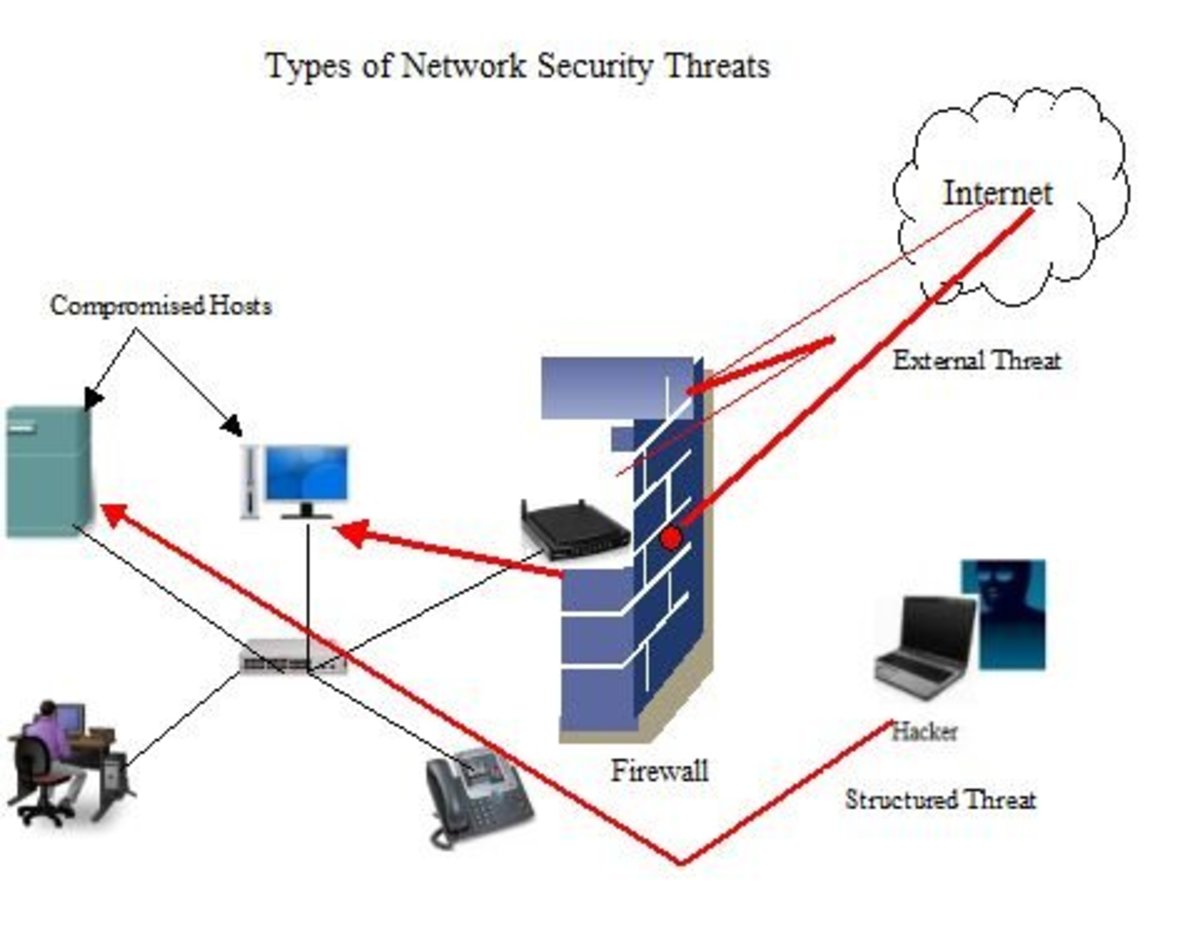

Online identity theft is a growing crime and everyone must take precautions when going online. You are at your most vulnerable when using a public Wi-Fi network. High tech identity thieves use sniffer software to steal information from you while you are using the laptop at a Wi-Fi hotpot in the public area of an airport or other public place. Criminals have also been known to set up fake Wi-Fi networks and use them to steal personal information.

You are not however safe from identity theft when using the computer in your own home. Criminals can use their technical knowledge and specialist software to break into your computer and steal personal details. They also use phishing emails to tempt their victims to reveal personal information about bank accounts, PIN numbers and credit cards. Some emails masquerade as official communications coming from a bank or telecoms company, asking for personal details. Criminals have also set up fake websites imitating those of banks or other companies in an effort to collect personal details from users.

New Amazon

How Identity Thieves Use the Information

Once your personal details are in their hands, the criminals may obtain your bank details and withdraw money from your account, or apply for a personal loan in your name that will add to your debts. They may apply for store cards or other credit cards and go on a spending spree at your expense. Although there is some legal consumer protection these criminals can cause you plenty of problems. The first thing you may know about this is a letter from a debt collector or lawyer threatening legal action. Your identity could also be used for purposes of illegally claiming benefits or refunds from the government, potentially landing you in embarrassing difficulties with the police that will require time and trouble to sort out

Preventing Identity Theft

It is very important not to give any details of bank accounts or credit cards over the phone in response to a cold call. In this situation you cannot check the identity of the caller and have no guarantee that the person calling is genuine. If you reply to a cold caller trying to sell something over the phone make a rule of never divulging any personal information. If you are drawn into a conversation against your will remember that you can end the call at any time. If it is totally against your character to put the phone down on anyone you can quickly thank the person for calling and then end the call.

In some ways fake emails are an even worse threat. Never give away any bank account details, PIN numbers or other personal information unless you are sure about the source of the email. Some phishing emails imitate institutions such as banks or telecom companies and ask you to confirm personal details such as account numbers, PIN numbers or passwords. In reality such institutions never send an email to ask for confirmation of such personal details. Some emails may also include links to enclosures containing spyware so it is best not to click on any links within suspicious emails.

To avoid personal documents being stolen and used to take over your identity make sure that all letters and bank statements thrown away are shredded before being put outside in the bin. Although many people are aware of the sensitive nature of bank statements they should also treat other letters as equally sensitive. A few utility bills in your name, falling into the wrong hands, could be useful to a criminal in trying to open an account or apply for a credit card in your name. Many paper documents such as bank statements and telecoms bills can be replaced by online notifications and this is a way of preventing this problem.

You should also be alert to the possibility of letters being diverted before they reach you. It is therefore important to quickly follow up any important letter that you should have received on a particular day but has not arrived. Any delay gives criminals time to make illegal use of the letters or of the information they contain. Once in a while something will go astray in the post and this should not be permitted to give any opportunity to anyone to steal your identity. In particular, if you are moving from one address to another make sure all the important institutions such as banks, insurance companies, telecoms companies and utilities are informed in advance, and if possible arrange for letters addressed to you at the old address to be sent on. There will always be one or two institutions that are informed of your change of address but do not alter their records in time.

In the case of a very important document such as a passport or a driving license it is important to act very quickly to inform the relevant authorities when these are lost. In most cases where such as document is missing it can be very difficult to pinpoint the exact time and place where it went missing. There is therefore always the possibility that it has been stolen. For this reason prompt action is necessary to report the loss and make sure the document is replaced. In the case of debit or credit cards, most people are aware of the need to immediately report and cancel any cards that are lost. This should be done as soon as the loss is discovered.

Prevention is the Best Cure

You should regularly check your bank statements to look for any suspicious looking items that may be a result of criminal activity. Online bank accounts should be reviewed regularly even if you have not performed any transactions. It is also wise to check your credit report at regular intervals to make sure that no criminals are accumulating debts in your name. The more checks you do and precautions you take the safer you become.